When increased independence was being given to central banks across the world, especially in their conduct of monetary policy, and in countries implementing an inflation targeting framework, a key element was greater accountability of central banks, in which transparency and appropriate disclosures had a very important role. Transparency refers to the flow and accessibility of information from the central bank to its stakeholders and the public. They rely on that information to inform their judgment of the performance of the central bank and compliance with the central bank’s mandate. Transparency is also a key plank in the central bank’s broader governance and accountability framework.

Central bank transparency is important for effective monetary and financial policies. Transparency is critical to guiding the decisions of economic agents and stabilizing market expectations and conduct, both of which boost the effectiveness of monetary and financial policies. Transparency is also key to ensuring public accountability of central banks and their autonomy/ independence, with the latter underpinning the operational effectiveness of central banks. Effective central bank transparency arrangements are one of the sound principles of monetary policy.

In July 2020, the Executive Board of the International Monetary Fund (IMF) approved the new IMF Central Bank Transparency Code (CBT). The CBT was prepared under the guidance of a High-Level Advisory Panel, consisting of eminent former central bank governors and academics, including Dr. Y.V. Reddy, former Governor, Reserve Bank of India, Alan Blinder from Princeton University, Mr. Masaaki Shirakawa, former Governor, Bank of Japan, and Mr. Daniel Tarullo, Former Governor, US Federal Reserve.

The CBT revises and updates the 1999 Monetary and Financial Policies Transparency Code (MFPT). It removes the overlap in the MFPT with transparency elements of financial policies covered by other international standards, and facilitates policy effectiveness through greater transparency in light of the emerging challenges facing central banks since the 2008 financial crisis in terms of expanded mandates, functions, powers and policy tools. Moreover, global responses to the ongoing Covid-19 pandemic has reinforced the need for central banks to adopt greater transparency to maintain public trust and policy effectiveness.

The Board had required that the CBT be relevant and balanced. In particular, the CBT should (a) be relevant to all member countries; (b) help facilitate a risk-based and proportional application while considering country specific circumstances and needs; (c) not be viewed as a central bank governance framework, nor as a means to assess the governance of central banks; and (d) strike the appropriate balance between transparency and the legitimate need for confidentiality.

The key features of the CBT are as follows:

1. It is a voluntary code, solely focused on central banks, and aims to encompass their broad range of mandates, governance frameworks, and institutional arrangements.

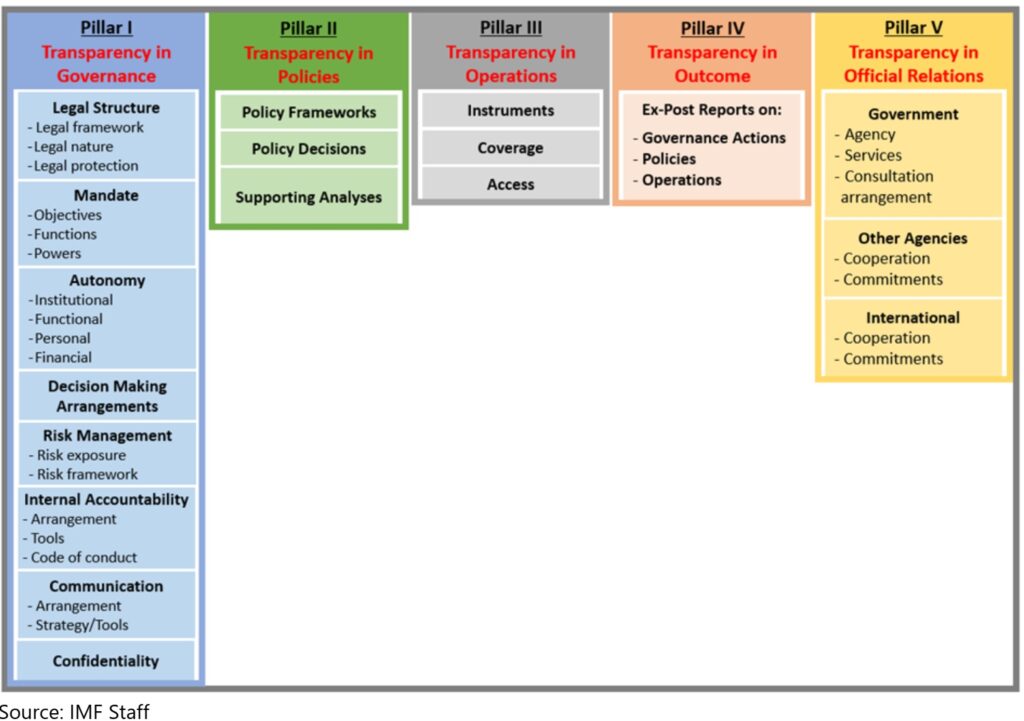

2. Its 5-pillar framework covers transparency in five broad areas of central banking:

Pillar I. Transparency in governance, covering institutional issues

Pillar II. Transparency in policies, focusing on the economics of central bank policy decisions

Pillar III. Transparency in operations, highlighting how policy decisions are implemented

Pillar IV. Transparency in outcome, focusing on how the outcome of central bank policies and other actions are reported to stakeholders to facilitate accountability

Pillar V. Transparency in official relations, covering the central bank interaction with the government and other domestic agencies, and international relations and commitments.

3. The enhanced transparency practices reflect the continuing evolution in the role and responsibilities of central banks since the financial crisis of 2008 and through to the Covid-19 pandemic, covering unconventional measures (including quantitative easing, forward guidance, lender and market-maker of last resort operations) in pursuit of their financial and price stability objectives and as part of the emergency responses. The unconventional nature and the immense scale of these measures, including the interlinkages with fiscal policies and impact on public welfare, called for enhanced transparency for central banks to underpin their actions as autonomous and accountable public institutions.

4. Removes overlap with financial policies covered by other international standards.

5. Allow central banks to map their transparency frameworks, improve the dialogue with their stakeholders, and contribute to policy effectiveness.

6. Central banks could self-assess their existing transparency frameworks. Allow better informed choices on transparency and effective communication with stakeholders. A better understanding of the rationale for central bank mandate, governance, policies, operations, outcomes, and official relations will reduce uncertainty and facilitate a public dialogue that can anchor public expectations and foster better policies.

7. Assist central banks in explaining that nondisclosure of specific information (for instance, on individual microprudential supervision cases) need not imply lack of transparency.

8. Provides a range of practices for implementation reflecting member countries’ central banks and their diverse backgrounds, legal frameworks, governance arrangements and levels of economic and financial development.

9. Recognizes the necessity to balance transparency and central banks’ legitimate need for confidentiality. The application of transparency in a central bank context cannot be indiscriminate or excessive as there are many central bank activities where there might be legitimate needs for confidentiality.

10. Identifies confidentiality needs in the contexts of market sensitive information, financial stability considerations, and personal data.

11. Recognizes the diversity of transparency practices across jurisdictions reflecting different legal, and structural backgrounds. Therefore, the CBT follows a two-pronged approach:

a. Transparency requirements throughout the CBT are qualified with respect to market sensitive information, financial stability considerations, and personal data.

b. In Pillar I, confidentiality calls for a clear confidentiality policy that explains and justifies the choices made by central banks on the disclosure of sensitive information, as well as those emanating from legal and other obligations.

12. Some of the key factors considered in drafting the CBT include:

a. Contribution of transparency to increased policy effectiveness and accountability.

b. Balance between transparency and legitimate needs for confidentiality.

c. Unconventional monetary policy practices of recent years that changed the traditional transparency principles related to monetary policy.

d. The broadening of mandates, functions, and powers—both de jure and de facto—of central banks, including macroprudential oversight, crisis management, resolution authority, and other objectives (e.g., financial integrity and consumer protection).

e. The need for the CBT to be practical and flexible to cover diverse central banking environments.

f. The Fund’s approach to governance and corruption related issues.

13. Serve as a diagnostic tool in capacity development, helping countries plan, implement, and monitor reform efforts.

14. Could support Fund surveillance. Will help highlight the strengths and weaknesses of transparency practices.

The revision in the transparency framework was overdue in the context of the changing and evolving role of central banks as evidenced during the financial crisis of 2008, and in the ongoing Covid-19 pandemic. The framework is based on more sound principles and should last longer than the earlier one which was around for a little over two decades. It contains a range of options, and the lesser developed economies, could transition from one to the other, as their economies and financial systems become more complex. But, it will be difficult to predict what the source of the next global financial instability will be, and whether these transparency standards would suffice to ensure continued legitimacy of and trust in monetary policies of central banks.

© G Sreekumar 2021

For periodical updates on all my blog posts, subscribe for free at the link below:

https://gsreekumar.substack.com/

![]()