This post is a twin of my last one on Teaching Ethics in Management and Accounting because they originated in my reading of two related articles on fraud by Seb Murray (Financial Times, 13 June 2022). As the post became too unwieldy, I decided that it made better sense to split it into two.

This post also takes off from a passing reference to Donald Cressey in another recent post on Strategic Risk in Banking. Another post on Fraud, Terrorism, and Bathtub, had mentioned how those who want to commit fraud learn the loopholes over a period of time. Those loopholes provide the opportunity for fraud as discussed below. The discerning reader may also find in this post a resonance of the determining factors mentioned in yet another post on Why People Wore Masks. While wearing a mask is an act of compliance with a regulation, committing a crime is deviant behaviour, essentially constituting noncompliance with socially and culturally accepted norms, and/or in defiance of legal or regulatory sanctions.

Donald Cressey

Donald Cressey (1919-1987) was a student of Edwin Sutherland (1883-1950), a sociologist. Both teacher and student were among the most influential figures in 20th-century criminology. In their profile of Cressey after his death, Ronald Akers and Ross Matsueda, both emeritus professors, and the latter a former student, described Cressey as “one of the most influential and productive scholars in the history of criminology.”

Contribution

As they explain further,

“Cressey’s value to all aspects of criminology, of course, went beyond the textbook. It grew out of his scholarly and scientific work in every major area of criminology. To be more specific, his presence in the field was felt most clearly in (1) criminological theory; (2) prisons, punishment, and corrections; (3) sociology of criminal law and justice; (4) organized crime; and (5) white-collar crime. Perhaps the most lasting influence will come from his understanding and use of criminological theory, especially his espousal, analysis, and application of differential association theory, because it pervaded virtually all that he did.”

Organised crime

Among these, they cited (2) and (4) as areas where he contributed the most. As for his contribution to the work on organised crime, they wrote as follows:

“In the case of the organized crime literature, he accomplished the goal consciously and almost single-handedly in the 1960s. Cressey viewed himself as an intellectual fire-starter, lighting a fire in one area, defining a sociological problem, and making research in the area respectable. Once the flames were sufficiently fanned, he would run off and start another blaze in a new area, leaving others behind to solve the problems and put out the fires.”

Akers and Matsueda, Donald R. Cressey: An Intellectual Portrait of a Criminologist, Sociological Inquiry, 1989

Principles of Criminology

Sutherland’s original Principles of Criminology, later carried forward by Donald Cressey as Criminology, now in its 11th edition with a third author and former student, David Luckenbill, has been the most popular textbook on the subject. It is something like the equivalent of Samuelson’s Economics for Criminology. Not surprising, as Cressey’s contribution to the subject has been as sweeping as that of Samuelson to Economics.

The Fraud Triangle

Cressey wrote in Other People’s Money: A Study in the Social Psychology of Embezzlement (1953):

“Trusted persons become trust violators when they conceive of themselves as having a financial problem which is non-sharable, are aware this problem can be secretly resolved by violation of the position of financial trust, and are able to apply to their own conduct in that situation verbalizations which enable them to adjust their conceptions of themselves as trusted persons with their conceptions of themselves as users of the entrusted funds or property.”

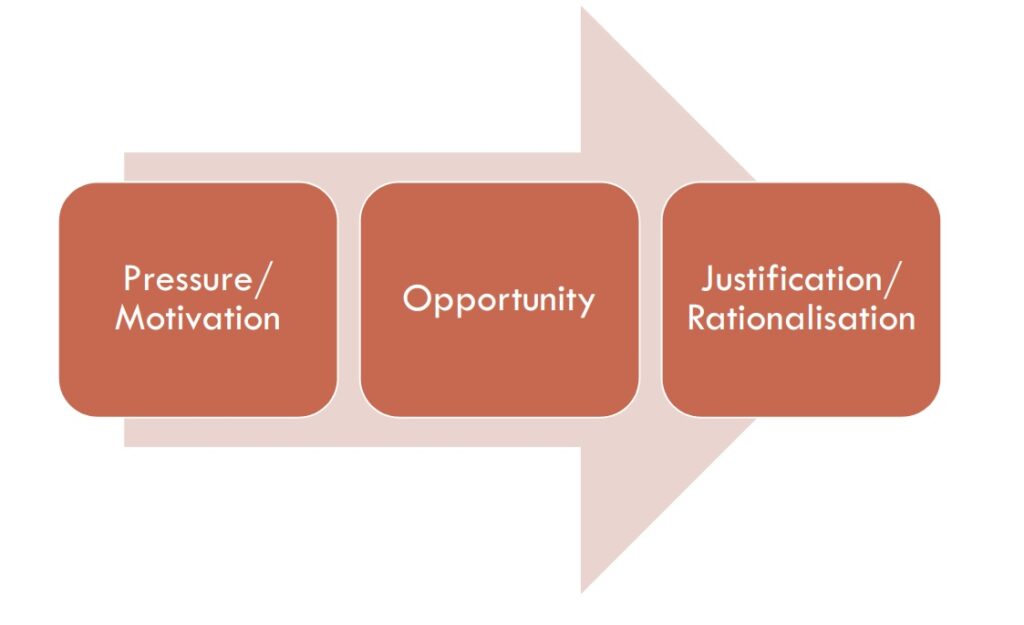

In simpler terms, one can visualise Cressey’s framework on why people commit fraud as a fraud triangle. Pressure, Opportunity, and Justification represent its three sides. I view them as three phases as explained below:

Cressey based his theory on interviews with 133 inmates in three different penitentiaries. It tried to answer the question of why people embezzle. The original basis for the theory was his guru, Sutherland’s supposition that embezzlement happens when trusted people believe that certain breaches of trust are merely technical, and not illegal. He modified this several times before coming to the fraud triangle.

Cressey’s contribution, despite attempts to extend the theory, has stood the test of time. His significant contribution to the sociology of crime came in 1953. This was more than a decade before the 1992 Nobel Economics Laureate Gary Becker’s seminal paper, Crime and Punishment: An Economic Approach (Journal of Economic Perspectives, 1965). Becker examined crime from a microeconomic perspective as against the macroeconomic perspective of William Bonger, the Dutch Marxist criminologist (Criminality and Economic Conditions, 1916).

Pressure/motivation

According to the fraud triangle theory, pressures in personal or professional life provide the initial motivation for a fraudster. Pressure to commit fraud could come from personal character or internal pressures. These include the following:

– inability to make ends meet

– heavy indebtedness

– lifestyle issues such as excessive drinking

– addiction to drugs, gambling

– sheer greed

– the sudden need for money for, say, medical exigencies

Work-related pressures could include the following:

– inability to accept failure

– ambition

– competitive spirit or wanting to match others’ performance

– impossible deadlines

– bonuses and other incentives

– urge to maintain a star rating

– work overload

In banking, examples are legion. In my post on strategic risk in banking, I mentioned the case of Wells Fargo, which pushed employees into defrauding the bank’s customers under pressure from work. There was the classic case of Nick Leeson, whose star rating as a trader, spurred him on to commit fraud so as to retain that and hide losses.

Opportunity

When someone is under pressure, opportunities provide the incentive and means by which fraud could be carried out. In an organisation, this happens when internal controls are absent or weak, and internal audit is ineffective. There are numerous ways in which controls could be weak. This could include non-segregation of functions involving a conflict of interest, non-observance of a four-eyes principle for material transactions as in maker and checker, not acting upon internal red alerts for fraudulent transactions, etc. Unreconciled transactions which make the detection of fraud difficult, if not impossible, provide another opportunity.

Opportunities can come in different ways. Assume that one security guard mans a critical exit at a currency facility. A senior watching from a distance also supervises his movements and the exit. If the security guard knows that at a fixed time the senior goes for some work for about half an hour, it provides him with a window of opportunity.

If there are two security guards, and if the duty allocation brings two close friends together at the same time, there is a window of opportunity.

Someone wanting to smuggle gold from, say, Dubai to Kochi, might get advance information of who are the customs officials on specific dates. The customs department, I believe, used to prepare these duty rosters well in advance. The information was reaching interested people in countries connected by flight with India well in advance. This is the bathtub curve effect, which we discussed earlier, coming into play. Thus, criminals could game practices which remain unchanged for long periods to achieve their objective. Days when known and cooperative officials man the customs gates provide an opportunity.

Justification/rationalisation

A combination of pressure and opportunity should suffice for those who are morally weak to commit fraud. They require no other reason. Even pressure may not be required. Perhaps none of these matter in extreme cases like kleptomaniacs. But, it helps to be able to justify or rationalise one’s action. Justification closes the triangle and makes fraud an imminent possibility.

This is where, according to Schuchter and Levi, “delinquents give themselves a ‘permission’ in terms of neutralizing the discrepancies between their own moral sensibility and self-concept, on the one hand, and the criminal violation of financial trust, on the other, described as rationalization.”

Examples of justification

Justification is essentially an inner dialogue. It could take one or more of the following forms.

“Nobody will notice it”. Such justification happens when there are unreconciled accounts, or large unspecified items of expenditure, all of which facilitate fraud.

“The fraud will never be traced back to me”. This also happens when there are weak controls and responsibilities are not properly fixed.

“Why should I be the only honest person around here”. One may so rationalise if governance is weak, the tone at the top is poor, and fraud and malfeasance are rampant.

“They deserve it the way they have been treating me”. The management could lose legitimacy in the eyes of an employee when compensation and other workplace practices are not fair.

“I will be able to put it back before anyone notices that the money is missing”. This happens when there is a lot of cash being handled and there are no proper and periodical checks.

“Nobody will ever suspect me, I have a sterling reputation”. This reflects a risk based on the Pollyanna syndrome where one is confident that others will only focus on positives.

“Even if I am suspected or caught, I can rely on my friends, peers, or my bosses to protect or cover up for me”. This refers to informal organizations within formal organizational structures that could contribute to this inner dialogue. These may be based on regional, linguistic or other social affiliations. Examples are old boy networks, sharing the same mother tongue, weekend partying groups, and playing badminton or tennis together.

Triangle vs. stages

Cressey’s theory has almost always come as a triangle. But, I prefer to look at them as stages where one keeps adding factors that contribute to the fraud. That is because, in reality, these three are temporally removed or sequenced. Pressure, I feel, is the starting point, after which one looks for opportunities. The internal dialogue that goes with justification is what settles the matter, unless one is looking for a fourth factor too.

Triangle or Quadrangle?

Wolfe and Hermanson, in 2004, added a fourth stage of capability or capacity, thereby converting the triangle into a quadrangle. Thus, for instance, one would need the ability to defraud in an IT environment, and also be able to cover up one’s tracks. One can define this as the ability to override internal controls, conceal the fraud, and manage any fallout to one’s advantage. The best-known case is Nick Leeson in the Collapse of Barings in 1995. Or, nearer home, the case of Shivraj Puri in the Gurgaon fraud of Citibank in 2011. In an IT environment, the possibilities of the fraudster knowing how to circumvent controls and commit fraud are high. When others in the environment, including unsuspecting customers or less-IT savvy colleagues, do not know what to look for to prevent fraud, they provide an opportunity for fraud.

Quadrangle or Pentagon?

More recently, Marks (2012) added arrogance as a fifth factor in converting the quadrangle into a pentagon. This is “an attitude of superiority and entitlement or greed on the part of a person who believes that internal controls simply do not personally apply”. This brings us to Leeson again. But, to me, this overlaps with opportunity and justification in many ways. And so does capability.

Going back a few decades, how many recall Rakesh Saxena, the Stephanian with Marxist political leanings as a student. His first fraud was relatively small, in foreign exchange transactions at the Oriental Bank of Commerce (OBC), in the 1970s. Those were the early days of foreign exchange risk after the Bretton Woods mechanism broke down in 1971. Not many people understood the complexities of foreign exchange business providing him with an opportunity. Definitely not the Thapars, who controlled OBC, and having approved Saxena’s transactions, could not implicate him.

Saxena went on to commit fraud after fraud both in India and across the world, in what is nothing but an act of arrogance and the ability to manipulate perceptions to his advantage. His colourful life, with even an alleged role in the death of Rajan Pillai, the Indian tycoon, is rich material for a book and a movie if anybody has the time for it.

The original fraud of 1978 at the Cochin Office of the OBC led in 1980 to the Reserve Bank of India issuing its first internal control guidelines (ICG) for the conduct of foreign exchange business. The RBI history for the period makes a passing reference to internal control on the functioning of authorised dealers in the foreign exchange business, but not to the events that led to it or the ICG.

The role of culture

In an organization, the role of culture in determining fraud is also important. One can view a weak organizational culture, as contributing to opportunities in the fraud triangle or as a cause for justification of their crime. That is a large subject in itself. I will keep it for a future post on organizational culture.

Concluding remarks

How can management or those in charge of controls make use of the fraud triangle theory to prevent fraud? Be on the lookout for factors that exhibit pressure on employees, provide them with opportunity, or the external environment that enables them to justify their acts. Is anybody leading an extravagant lifestyle beyond his or her means? Expensive cars and holidays? Are there control weaknesses? Is someone insisting on posting at specific places and with specific people? Would the organizational culture contribute to fraud in some way? The possibilities are almost endless and might require meaningful brainstorming to identify weaknesses.

Finally, the fraud triangle is only one among many ways of conceptualising why people commit fraud.

© G Sreekumar 2022

For periodical updates on all my blog posts, subscribe for free at the link below:

https://gsreekumar.substack.com/

![]()

Just asking if you had any views on bank loans being given to Corporates and a sizeable portion being written off as NPA’s.

My post was on individuals committing fraud in organisations. Corporate loans being written off by banks is another big topic in itself. Some of them might constitute fraud. These may be done by the borrowing company itself, in collusion with bank officials, or even with the active engagement of third parties, including gatekeepers such as valuers who value mortgaged properties, lawyers who certify the underlying rights, and chartered accountants who certify accounts. Writing off loans, by the way, does not mean that banks stop pursuing those cases. This is a common misperception. What it means is that banks have fully provided for the loans. To that extent, profits will be less but will present a better level of NPAs. But banks will continue to pursue the cases in courts and elsewhere. Police investigations will also continue. Having fully provided for the loans, future recoveries will go straight to profit. My abiding interest in frauds stems from many investigations that I had conducted in frauds and money laundering, having headed the frauds division at the RBI, and my experience as secretary to a fraud-related board chaired by S.S. Tarapore, former Deputy Governor, RBI. In future posts, I hope to share some insights to the extent I can without of course going into individual cases.