A critical look at IMF recommendations on financial stability concerns from Fintech and DeFi

Fintech and financial stability

Fintech is technological innovation in financial activities, or in other words, financial innovation aided by technology. This by itself is not new. The ATMs which made their entry in the late 1960s was also in this sense, fintech. With the rapid growth in crypto assets in recent years, and that of decentralised ledger technology (DLT), fintech has evolved and grown rapidly in recent years to provide traditional banking functions, including deposit taking and lending. Referred to as Decentralized Finance, or DeFi for short, it threatens to disintermediate banks from savers and borrowers, transform the traditional banking landscape, and threaten financial stability. The IMF flagged its concerns in the third chapter of the April 2022 issue of its biannual Global Financial Stability Report (GFSR).

The third chapter of the GFSR is titled “The Rapid Growth of Fintech: Vulnerabilities and Challenges for Financial Stability”. It focuses on fintechs and fintech platforms (DeFi) that provide core banking services: deposit-taking and credit intermediation. Both are central to both the functioning of an economy and to financial stability. Fintech has also entered other financial services too such as payments, asset management, insurance, and crypto assets.

Fintech and DeFi

Technology has been changing the face of banking ever since the advent of computers and automation. ATMs, core banking, internet banking, and payment system advances, have made traditional brick and mortar branches irrelevant for daily banking. DeFi goes a step further in unbundling different functions of traditional banking. Eswar Prasad called this process Legoification of finance. The reference is to the building blocks of the Lego line of plastic construction toys. Please check my review of Prasad’s Future of Money.

DeFi is facilitated by blockchain, a type of distributed ledger technology, which in turn facilitated smart contracts that changed financial intermediation, and stablecoins pegged to existing sovereign currencies were a key innovation. Smart contracts are financial application processed by computer code on blockchains, which records all contractual and transaction details on the network, with limited or no involvement of centralized intermediaries. DeFi involves automated and decentralized record keeping, risk-taking, and decision-making within the crypto ecosystem. Changes in collateral and profit distribution are made by voting users. It is thus accessible to players of any size and requires no custodian, improving efficiency and financial inclusion. DeFi lending platforms receive crypto assets as deposits, pays interest on them, and lend them to borrowers who meet certain collateral criteria. It grew in tandem with stablecoins, and could grow faster with greater efficiency, attracting more crypto investors.

Fintechs insert themselves at various points along the financial intermediation chain, that traditionally involves liquidity, maturity, and credit transformation. This makes them nimbler with a better ability to provide efficiency and customer experience.

Benefits of fintech

Fintech could reduce costs and frictions arising from information asymmetry, increase efficiency and competition, and lead to financial inclusion, especially in low-income countries, and for underserved populations. They also have the potential to leverage the greater efficiency and accessibility to offer more innovative, inclusive, and transparent financial services. The competition they give to traditional banks is beneficial from a purely economic perspective.

Growth in fintech

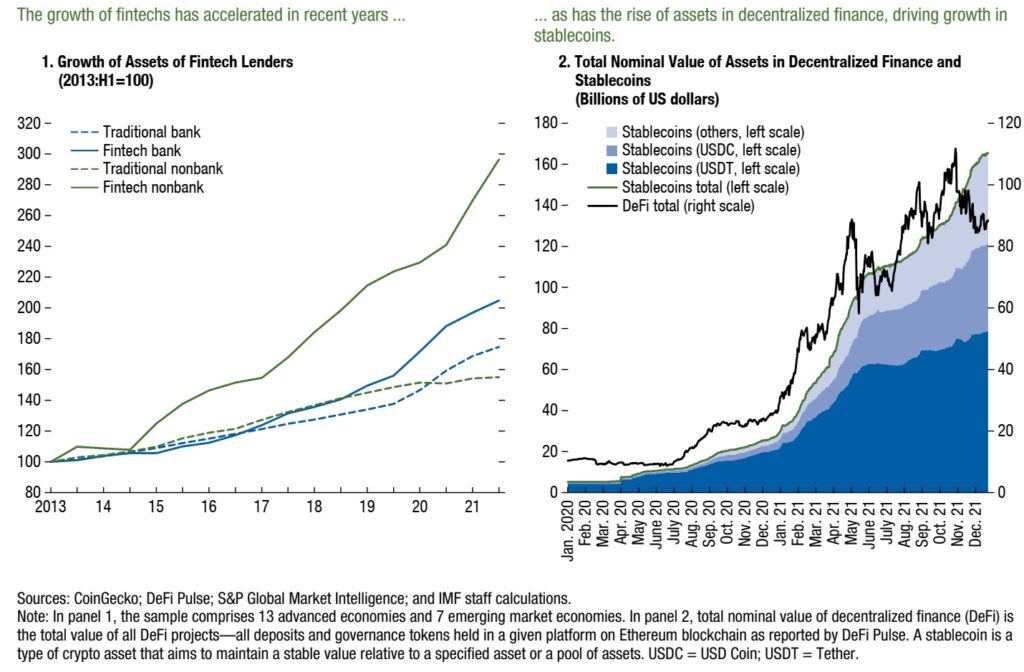

DeFi is crypto-market-based where financial transactions are performed on a network without a central intermediary. Growth in fintech and DeFi is due to the development of DLT, smart contracts, and stable coins. Fintech is increasingly disrupting core financial services traditionally provided by banks. DeFi grew rapidly in tandem with the crypto ecosystem. There has been substantial growth in the past two years with the pandemic also giving a boost to its growth. Please see the graphs below:

The tsunami-like waves in the graphs could remind you of Katsushika Hokusai’s famous 1831 painting, The Great Wave Off Kanagawa, seemingly holding the distant Mount Fiji in its grip. It reminded me of the phenomenal and exponential growth of credit derivatives in the first decade of this century. They should wake us to the potential for disruption in the not too distant future. The GFSR illustrates through case studies of digital banks, or neobanks, and the role of fintech in the US home mortgage market.

Digital banks or Neobanks

Digital banks, or neobanks, are branchless banks. They directly acquire and serve customers primarily through digital touchpoints such as mobile apps.Unlike traditional banks, they use cloud computing, application programming interfaces, big data, artificial intelligence, and other such digital technologies to make banking available on any device any time.

Neobanks are systemically important in many jurisdictions with market capitalisation rivalling large traditional banks. Though balance sheet size may be small, high valuations reflect expectations of future growth, especially in unsecured retail. Rapid scaling will bring value and also higher vulnerability to operational risks such as fraud.

Neobanks target riskier and underserved borrowers across consumer, credit card and SME segments. They are usually unsecured loans to younger, but technologically literate, individuals with lower incomes and credit scores, or concentrated around risky sectors, such as commercial real estate.

Despite higher credit risk, the coverage ratio of neobanks is much below that of traditional banks reflecting looser provisioning standards. Similarly, despite carrying higher credit risk on their books, neobanks under-price credit risk. Typically, the higher credit risk in the loan books is cross-subsidised by their higher yielding, and riskier, investment portolio.

The younger client base is fickle and their deposits less sticky, requiring higher liquidity coverage. But, the present liquidity is lower than that of traditional banks. Neobanks are also more interconnected than traditional banks with the rest of the banking system with systemic implications.

Neobanks’ operating expenses, for non-staff, customer acquisition and compliance, are higher. But, fee income is low, with low cross-selling potential to low income customers. They are thus less cost-efficient. This leaves only a few profitable neobanks. Neobanks in emerging market economies, in the early stages of their life cycle, with better business models, lower liquidity risk, stronger revenue profile, and wider loan and fee margins, fare better.

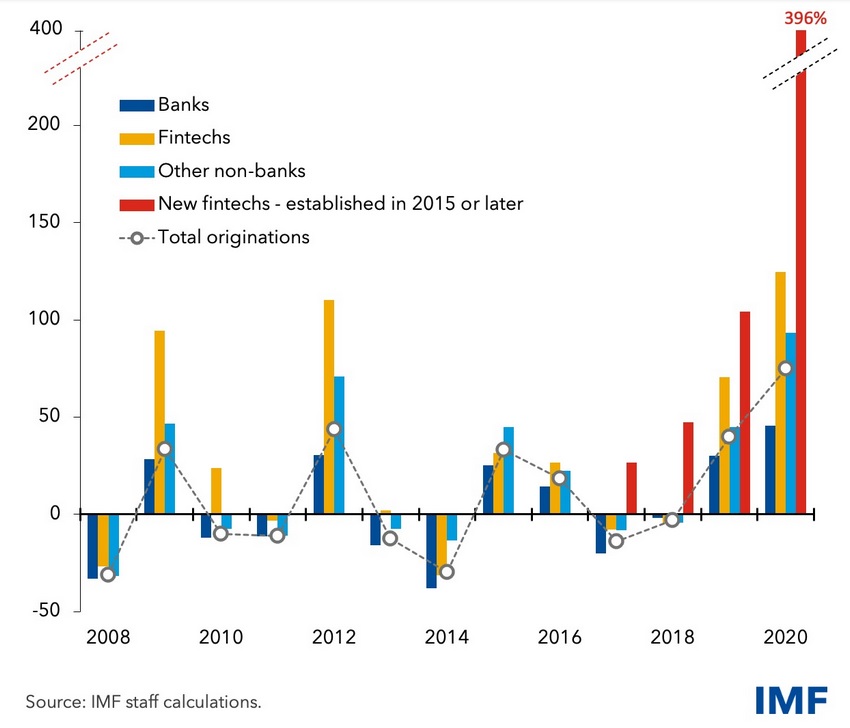

Fintechs in US Home Mortgage

US home mortgage fintechs also more efficient by not having physical branches and 20 per cent faster loan processing. Their aggressive growth strategy targets younger and riskier borrowers with higher loan-to-value ratios. They improve access to mortgages in less affluent areas. Direct competition with banks raises financial stability challenges. Though growth of fintechs have reduced bank profitability, the latter remain in business with 40 per cent share in mortgages originated. This is because banks also accept deposits, while fintechs’ role in mortgage-origination does not extend to deposits.

The challenges of fintech

Risks in fintech

Fintechs are growing fast in a wide range of financial services, aided by gaps in regulation that favourably treats them on par with financial services. Though some individual fintechs are small, they can scale up rapidly, across riskier business segments and riskier clients. Apart from the inherent risks in the technology-driven models of digital banks, the fast growth and the increasing importance of fintech financial services for the functioning of financial intermediation gives rise to systemic risks. The speed, reach, and depth of these changes give rise to systemic risks and pose challenges to financial stability.

Leverage

Investors using DeFi platforms often borrow stablecoins to buy risky crypto assets, called a leveraged long position. They may also sell risky crypto assets and buy them back later in a short sell position. Over 90 percent of DeFi lending is in stablecoins, while 75 percent of the collateral is volatile crypto assets such as Ethereum and Wrapped Bitcoin. Apart from the leverage inherent in these transactions, the stability of value in one leg of the transactions and volatility in the other have a built-in instability especially when used for speculation with no underlying position to hedge against. The asset quality of DeFi lending varies across assets and borrower risk profiles.

Pricing risk

By bypassing intermediation, DeFi is able to have lowest marginal cost and highest cost-efficiency. This reflects their automated and unregulated operations as against much higher labour and operational costs including regulatory compliance costs in traditional finance. But, its funding costs are higher reflecting higher risks, lack of central bank support, money laundering risks, and legal and jurisdictional uncertainties. This results in under-pricing of the riskiness in its lending. Lower margins build vulnerabilities during market stress and unfair competition to better regulated incumbents.

Other risks

DeFi could expand to mortgage lending, consumer finance, etc. It is also subject to market, liquidity, credit, operational, and cyber risks, as in traditional lending. The vulnerability to cyber and money laundering risks is higher due to loopholes in computer code and anonymity afforded by the platform.

Cyberattacks mostly target or involve wallet keys, vulnerabilities in computer code, data privacy concerns, and scams by developers. These could cause large and persistent losses, including collapse of an entire platform.

Financial stability implications

Fintechs provide bank-like services but operate under less stringent regulations than banks. If left unregulated, fintechs risk bank disintermediation. As financial intermediation moves from traditional banks to DeFi, risk is moving to unregulated areas. Risks moving to under- or unregulated entities poses challenges to regulators in the form of regulatory arbitrage, interconnectedness, and contagion. The lax regulation for digital/neobanks, for liquidity, loan classification and provisioning, may incentivise risk-taking in loan underwriting and securities investment. Scalability allows fast growth of fintechs. This requires regulation and supervision to take care of the build-up of vulnerabilities, including better consumer and investor protection.

Interconnectedness

Financial stability concerns are also enhanced by the increasing interconnectedness. With the rapidly increasing adoption of DeFi by institutional investors, the linkages with traditional financial institutions are growing. DeFi activities are so far taking place mainly in crypto asset markets, but they can increase the interconnectedness of crypto investors, among themselves and with traditional finance. The rapid growth of fintechs worldwide has increased interconnectedness and financial stability challenges:

(1) higher risk-taking in retail loan originations without appropriate provisioning and pricing standards

(2) higher risks in investments cross-subsidises and underprices lending

(3) underspending in critical risk management and compliance functions such as cyber security and anti-money laundering to meet market expectations.

(4) liquidity buffers not commensurate with less volatile retail deposit base.

(5) Neobanks funding traditional banks in the interbank market

(6) Providing cloud services and other critical support to others

(7) Unhealthy competition making others take excessive risk to stay in business or defend market share.

In the past, banks have adopted new technology by having tie-ups with fintechs. It can also happen through M&A. These pose their own system risks, say, when banks integrate third party services with its own risk management and compliance processes. Or when many banks depend on same service providers. Unfair competition also comes when fintechs are in direct competition with banks for the same services in areas which are less banked and fintechs find direct customer-facing services more lucrative than business-to-business services. In the process of fintechs disintermediating banks, savers/investorsare required to assume credit and liquidity risks against risky collateral provided by borrowers.

IMF suggestions

DeFi’s anonymity, lack of a centralized governance body, and legal uncertainties make traditional regulation ineffective. GFSR calls for globally consistent regulation and enhanced surveillance. The IMF’s GFSR recommends reviewing prudential regulations at entity and group levels covering capital, liquidity, and operational risk-management. Second, it suggests that supervisors closely monitor technologically less advanced and smaller banks with insufficient resources and know-how to adapt to the changing scenario.

Specifically, it suggests the following:

- focus on stablecoin issuers, crypto exchanges, wallet service providers, reserve managers, network administrators, and market makers

- regulate key DeFi functions such as risks generated by protocol developers

- public-private collaboration on code regulation through ex ante guidelines on operational and risk parameters (including operational and cyber resilience) or ex post code reviews and audits that can identify areas vulnerable to risk and help deliver policy objectives.

- ex ante measures can be combined with greater disclosure and user education to help identify platform-specific risks, closing the information gap between retail and institutional investors.

- encourage DeFi platforms to adopt robust governance through industry codes and build effective public-private collaboration to establish self-regulatory organizations (SRO).

More on SROs

The GFSR also goes on to suggest a “transparent and credible governance system to improve risk management, facilitate good conduct of financial transactions, and attract more users and capital to the platforms”. According to it, “such a governance system could be a natural entry point for regulators to interact either directly or through the development of industry codes or self-regulatory organizations.”

It hopes that these SROs will be a conduit for regulatory oversight, ensuring that DeFi platforms enhance disclosure and have suitable controls. Further, the report hopes that the SROs for “centralized crypto exchanges would lead to more robust listing standards for (tokens of) DeFi platforms and thereby improve their governance and quality”.

It, however, adds the caveat that “Regulators should monitor the effectiveness of industry codes and self-regulation and enhance supervision intensity when necessary”.

A useful addition is the suggestion that the exposure of regulated firms to DeFi markets be restricted so as to address the risk of interconnectedness.

Comments

Approach

In my view, one cannot regulate away the force of technology. The IMF, thus, does not address how traditional banks can be kept isolated from the effects of technology-enabled market forces unleashed by the greater agility and low-cost business model of fintechs that will compete for the same business. It assumes that traditional banks and the new breed of fintechs will coexist.

SROs

Self-regulation as a regulatory model was discredited more than two decades back with the unravelling of Enron. I wonder whether the IMF is really serious about the role of SROs. That too in an industry where there exists free entry and free exits. The turnover is likely to be quite high, especially in the early stages of its life cycle.

Monitoring SRO is as good or bad as no SRO or direct regulation. But to take a kinder view, the devil will be in the details.

Comprehensive approach

For the same reasons as above, regulating governance of the entire ecosystem including stablecoin issuers, crypto exchanges, wallet service providers, reserve managers, network administrators, and market makers, may not be practicable or worthwhile.

One cannot look at the threat of fintech or DeFi separately from a coherent and comprehensive approach to stable coins and the entire crypto system. I had suggested in my review of Prasad’s Future of Money banning the crypto system that challenges traditional currency and payment mechanisms. In their absence, perhaps the DeFi challenge will disappear.

Way forward

The best way out would be to incorporate the advantages of fintech technology in traditional incumbents so that the need for proportional regulation and differentiated treatment would disappear.

The system needs to be watchful against those smart kids, armed with technical knowhow and the financial backup, training their guns at traditional finance for likely money making opportunities, like boys playing with toy guns. They are not in it for a philanthropical pursuit of reforming and modernising finance. As Slick Willie Sutton, the famous bank robber, replied, when asked why he robbed banks, “That’s where the money is.”

The report will, however, be a useful starting point for detailed discussions on the shape of regulation to meet the challenges of fintech. Perhaps, that is about all that the report serves. But, time is running out.

© G Sreekumar 2022

For periodical updates on all my blog posts, subscribe for free at the link below:

https://gsreekumar.substack.com/

![]()