The growth of cryptocurrencies in the last decade has forced many central banks across the world to consider issuing their own version, called Central Bank Digital Currency (CBDC). There have been several studies, official and private, that examine the pros and cons of introducing CBDC. Eswar Prasad in his new book provides a comprehensive look at the entire gamut of issues relating to CBDC.

My review of Eswar Prasad’s new book on fintech, cryptos, and CBDC: Future of Money: How the Digital Revolution is Transforming Currencies and Finance.

Contents

Introduction

Fintech

Crypto Mania

Regulatory Concerns

Central Bank Concerns

National Responses

Central Bank Digital Currency

Relevance of CBDC

Critique of CBDC

CBDC and EMEs

Whether CBDC and when

Designing CBDC

Current status of CBDC and lessons

Impact on cash

Impact on dollar

Global currency

CBDC in India

Conclusion

Postscript

Introduction

William Stanley Jevons started his career as an assayer in a mint in Sydney. In 1855, sending money to his father, Jevons wrote:

“I must say the money has given me very little satisfaction, except that of sending it home. Whether in the bank or in your pocket I find £100 like a very disagreeable weight on the mind, so I shall be very glad when it is off my hands, though I hope safe in yours.”

Harriet A. Jevons, ed., Letters and Journal of W. Stanley Jevons, p. 52

In 1875, as a professor of ‘political economy,’ Jevons laid down the functions of money in Money and the Mechanism of Exchange. These are unit of account, store of value, and medium of exchange. Money combined these functions performed earlier by different objects. Even today, it remains a useful framework for assessing currencies.

After paper currency (8th century) and fiat currency (13th century), money is in for a third major makeover. Private players are creating digital money using cryptography, called cryptocurrencies, virtual currencies, or the generic ‘Bitcoin’. Central banks call them crypto assets. Stablecoins are a more stable subset of cryptos, their value linked to a basket of currencies. Eswar Prasad in his new book evaluates these and the future of money.

Fintech

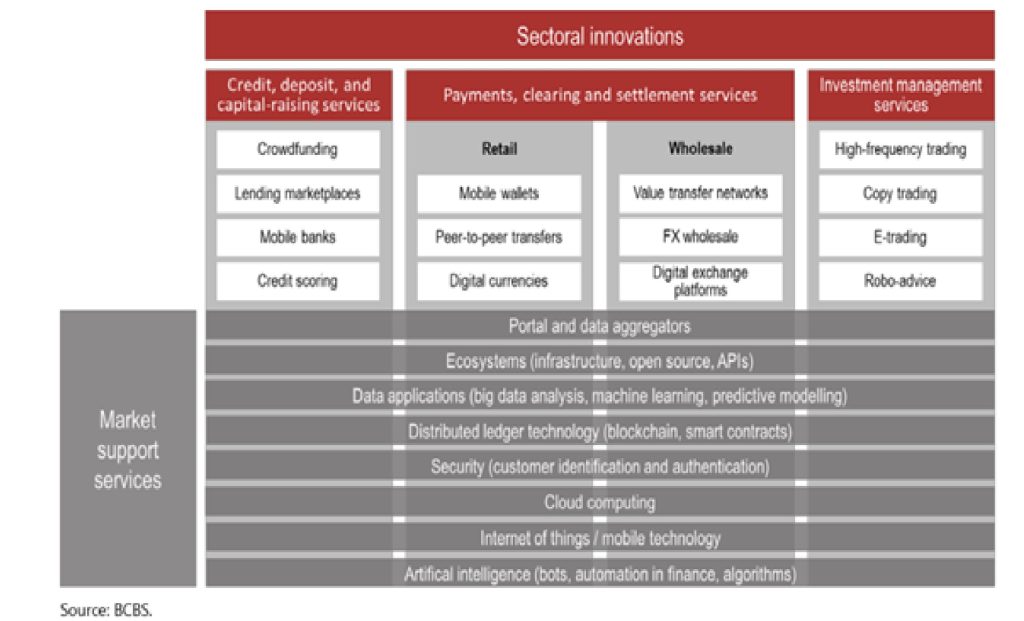

Fintech encompasses a wide range of activities (see table).

While immediately preceding innovations used existing technology in transformative ways, fintech itself is transformative. It can improve financial inclusion, make government receipts and payments easier, and cross border transfers cheaper.

Fintech facilitates unbundling different bank functions and reassembling them into different products. This Lego-ification has led to development of innovative products. Decentralised Finance (DeFi) is an offshoot of decentralised blockchains. These digitally distributed transaction records are connected in a peer to peer network. With no centralised points, controls are with network members, and trust is based on consensus. Prasad lists its advantages as “Fault tolerant, attack resistant, collusion resistant, permission-less (anyone can use), censorship resistant (no one can stop it), and open where a transaction is transparent.” The disadvantages are also many including proneness to frauds and software issues. Cryptos are a similar innovation in money aimed at making the three functions of money more efficient.

Introduced in 2009, the popularity of Bitcoin spawned a phenomenal growth in cryptos. From less than 100 a decade back, it is around 10,000 now. Its benefits included transaction ease, high security, low costs, anonymity, and a decentralised structure. The transactions are real-time transparent, verifiable, and immutable. It also facilitates ownership and exchange even without the trusted backing of a government or central bank. Data stored in blockchains are less vulnerable to fraud, hacking, entry restrictions, and double counting/spending. It also enables countries like Iran, Russia, and Venezuela, to circumvent US sanctions.

Crypto Mania

Perhaps the biggest weakness of cryptos is their volatility. As a result, it fails all three functions of money. The lowest Bitcoin value in five years till 2021 was $788. In 2021, it ranged from $18,279 to $67,582. Second, slowness in validation fails them as medium of exchange. Bitcoin handles about seven transactions per second as against thousands through conventional payment gateways.

Third, as a unit of account, there is no advantage over reserve currencies. Fourth, despite blockchain and distributed ledger technology (DLT), cryptos remain vulnerable to hacking. On 30 March 2022, quoting Crystal Blockchain, a research firm, Wall Street Journal wrote:

“Since 2011, there have been 226 hacking incidents—not including the “Axie Infinity” hack—that have led to the theft of $12.1 billion, … In 2021, there were a record 75 incidents that resulted in $4.25 billion being stolen, … The largest crypto hack was in August 2021, when a DeFi protocol called PolyNetwork lost assets valued at $611 million at the time of the hack.”

Wall Street Journal, 30 March 2022, page B7.

Fifth, transparency and connections across different human activities can enable government surveillance. Sixth, despite claims to the contrary, anonymity remains a chimera.

Seventh and perhaps most importantly, cryptos harm the environment. In electricity consumption, Bitcoin would rank higher than 150 countries (slightly above Norway, wrote WSJ, 30 March 2022). An eighth issue is its links with the Silk Road, the online black market. The share of cryptos misused for money laundering is much higher than dollar or other major currencies. Prasad calls it “a libertarian or crook’s dream.” Ninth, there is no remedy when payment goes to wrong digital address, digital wallet is locked up, or when private key is lost.

Notwithstanding the above, the disruptive effects of DLT will change money forever.

Regulatory Concerns

Even though technology could reduce information cost, the consequent information overload makes separating signals from noise difficult. The resulting herd behaviour could cause flash crashes and volatility, testing regulatory agility and independence. Unregulated entities with new, cheaper, attractive, and innovative products, pose unfair competition to regulated entities. As in the global financial crisis, significant risks might have moved to unregulated sectors. Regulatory sandboxes balance innovation and risk mitigation. It hastens regulatory approvals, facilitates funding and growth, and provides critical feedback to all.

Central bank concerns

Will crypto reduce currency use and end central banks? There are also issues of privacy, money laundering, consumer protection, monetary policy concerns, and foreign exchange risks. The effect of crypto on monetary policy transmission is not clear. But, it could make managing inflation, unemployment, and growth rate difficult as an activity serving no real economic purpose would cloud economic indicators and difficult to interpret.

A globally accepted crypto could weaken control of capital flows through unregulated channels. This could increase spillover effects of major central bank policies. Consequent exchange rate volatility and dollarisation could threaten emerging market economies (EMEs). In weaker EMEs, crypto could challenge local currency for store of value and medium of exchange functions.

National responses

Agustin Carstens of Bank for International Settlements (BIS), described Bitcoin as “a combination of a bubble, a Ponzi scheme and an environmental disaster.” Mark Carney said that crypto prices exhibit classic hallmarks of bubbles. The national responses ranged from a benign wait and watch to outright ban, with regulation tightening as cryptos competed with greater efficiency for the three functions of money. The announcement by Facebook (now Meta) in 2019 of its stablecoin, leveraging three billion users, shook central banks into action. The result is Central Bank Digital Currencies (CBDC), an official version of crypto.

Central Bank Digital Currency

Relevance of CBDC

Governments need to provide equally low cost, secure, convenient and resilient alternative before it can legitimately ban cryptos. The other arguments for such CBDC include reduced cash dependence, transactional efficiency, backstop to private payment systems, financial inclusion, possibility to have interest rates below zero, facilitation of helicopter drops of money, larger formal economy broadening tax base and reducing tax evasion, and increased ability to fight financial crime. It would come cheaper as cost would be borne by the central bank out of seigniorage.

Prasad argues that CBDC could promote monetary sovereignty and an effective lender of last resort function though he does not make the latter clear. His claim that the zero lower bound in interest rates could be breached seems unrealistic as the depositor can resort to ‘flight to cash’ instead of withdrawing to spend. CBDC can effect direct credit, a digital version of helicopter drops, assuming that all needy households have CBDC accounts. Such drops may benefit only those with knowledge and ability to open such accounts, deepening the digital divide. At the same time, India has achieved a partial reach even in the absence of CBDC.

While CBDC’s digital trail could mitigate tax evasion, corruption, and money laundering, as Prasad argues, this may only change the nature of crime.

Critique of CBDC

The most important argument of the critics of CBDC is that, in times of stress, ‘flight to CBDC’ could aggravate financial instability. If CBDC is a digital equivalent of cash, ‘flight to CBDC’ is just another name for ‘flight to cash’. Moreover, bank withdrawals could be restricted during a crisis like the Bank Holiday in the US in 1933 or moratoria for individual stressed banks.

Second, why should central banks do what the private sector can do well. Third, technological weaknesses in CBDC could affect public confidence. Fourth, by having a direct interface with public, central banks may have to deal with compliance issues like KYC. These would finally depend on the CBDC design. At the same time, in India, retail payments are increasingly digital. So what value can CBDC add remains unanswered. Critics argue that there is no case for CBDC.

CBDC and EMEs

The success of CBDC in EMEs would be constrained by credibility of their central banks, and large informal sector, with implications for taxation, regulation, and crime. Dollarisation is a challenge in some countries. Technology, and limited digital and financial literacy, are constraints even in certain advanced economies.

But, EMEs can benefit when central banks take the initiative instead of leaving it to markets. The success of their CBDC would be a factor of central bank reputation and economic policies. Even without such supporting factors, CBDC could improve financial inclusion and payment system efficiency.

Whether CBDC and when

Countries with globally accepted currencies see no urgency in introducing CBDC even though it could make their monetary policy more effective. For EMEs, Prasad suggests a multi-track approach. This includes technologies to improve financial inclusion, retail payments, and household welfare, through sandboxes before scaling up. DLTs could make interbank payments more efficient.

A successful strategy balances the unforeseen and unhedged risks in being too early with the losses in being late. To manage the transition, Prasad suggests that a partially or fully dollarised economy link its CBDC to a reserve currency. He also suggests that EMEs take a collective and coordinated approach on a regional basis to promote innovation and financial stability.

Designing CBDC

CBDC could be wholesale or retail. Of these, wholesale is inter-institutional. These are mostly digital for governments, banks and others with central bank accounts. DLT with a centralised architecture could make operations more secure and efficient. In India, it could smoothen government receipts and payments without intermediating banks.

Retail CBDC, from mobile-based e-money to account-based CBDCs, helps central banks control financial markets. CBDC could also be two-tiered where transaction verification is centralised at the central bank or its agent, while commercial banks manage retail accounts. In what IMF (2022) calls a synthetic CBDC, as against unilateral (directly with end users) and intermediated CBDCs (through banks), the government or any non-central bank actor could introduce official cryptocurrencies with greater anonymity.

Form of money is culture- and demography-driven. Cash usage is high in Switzerland and Japan. In Japan, this is due to ageing population, premium on privacy, low crime, high population density, and because they are accustomed to cash. Some hotels in Norway do not accept cash. When merchants refuse cash, it marginalises the disadvantaged. When law is amended to provide for CBDC, it should provide for receiving cash and coins an obligation as in the US.

People value privacy more than safety or other CBDC features. While not obligated to guarantee privacy, government should combine identity privacy (who is transacting) with transaction privacy (nature and amount). Different grades, with high privacy but low balances and low level of transactions, to low privacy but higher balances and transaction limits could be thought of.

Perception of CBDC as government tool for implementing economic and social policies could compromise central bank independence and credibility detracting from the effectiveness of its core functions. This is all the more reason that central banks issue its CBDC through other financial institutions.

Current status of CBDC and lessons

Prasad rightly says that CBDC cannot mask weaknesses in central bank credibility, and fiscal indiscipline. CBDCs cannot be more credible and successful than the underlying paper currency. But, a few small countries have introduced or piloted CBDC. China’s pilot e-CNY is a digital replacement for cash with few additional features or functionality. The four major central banks and most others are in different stages of planning and piloting. Based on current experience, Prasad draws various lessons.

Prasad lists the following attributes as the holy grail of an efficient digital payment system: security, resiliency, low latency, and high throughput. The first two relate to technological integrity. Latency relates to time for validation and settlement, and throughput to volume handled. A decentralised consensus structure results in low throughput as in Bitcoin. CBDC, even if on a blockchain, given its huge volumes, cannot be decentralised.

Regulatory sandboxes will provide useful lessons to early experimenters. The intermediated approach where central bank issues while intermediaries distribute CBDCs and maintains CBDC wallets avoids disintermediation, promotes innovation, and insulates central bank from front-end payments and compliance issues.

A ceiling on CBDC balance, as in The Bahamas, limits flight to CBDC. But this can also be achieved by a pre-announced negative interest rate. In providing anonymity, central banks should avoid private cryptos and technologies used by them.

Technology should balance legitimate privacy and auditability. Central banks are under no obligation to guarantee anonymity which does not anyway exist for large value transactions including in India.

Prasad suggests that wholesale CBDC be special purpose digital tokens issued to banks in exchange for currency or bank reserves to settle interbank debts. Such debts are settled between their accounts with the central bank. Nor will this reduce liquidity and collateral in payments as Prasad expects.

Impact on Cash

While cash is exiting different countries for different reasons, some countries also prohibit refusal of cash in transactions. Prasad defends cash on grounds of freedom and liberty. libertarian argument that government issue cash that could undermine government policies, regulations, and law enforcement may be contradictory. But, by avoiding the separation of purchase and payment as in many digital equivalents, cash promotes thriftiness which should be a choice with the public. Cash also needs to be continued and its acceptance mandated, to avoid deepening the digital haves and have-nots divide. The answer is thus not cash or digital, but ‘cash and digital.’

Impact on dollar

Dollar’s pre-eminence in global finance since the Bretton Woods has been continuing for long even after it came off convertibility in 1971. The ‘exorbitant privilege’ of being the global currency of choice for all functions of money enables the US to borrow cheap, fund its current account deficits, and maintain hegemony in global affairs. This continued dominance even in the absence of convertibility has only strengthened dollar’s position. According to Prasad, it is not clear that cryptos will succeed where the Euro and the Renminbi failed. But, competition and the changing landscape of cross-border payments could trim dollar’s dominance as a medium of exchange and unit of account.

Martin Wolf wrote, in the context of US sanctions against Russia, “weaponisation of currencies will fragment the world economy and make it less efficient.” (Financial Times, 30 March 2022). Such sanctions helped cryptos grow in the past. The unit of account function would take time to dislodge as global comparison of prices require an anchor currency.

The ‘store of value’ function requires a strong existing reserve currency with depth and liquidity in the markets. It also requires backing of a powerful institutional framework including rule of law, checks and balances, and a trusted central bank. The dollar’s position here will remain unassailable for much longer even though Benoît Cœuré, Head of BIS’s Innovation Hub, argues that private digital forms of money could challenge the dollar’s supremacy.

While incumbency advantage and network effects could make new entry difficult, switching costs are lower in retail payments. Factors driving international currency use are changing and new currencies have advantages. Competition between international currencies both new and old could become more heated and dynamic in the future, with the advantages of incumbency no longer as powerful as they once were.

Global currency

A global currency has been a holy grail since the gold standard failed in 1931. The debate has started afresh in the context of cryptos. Technology can solve the challenge of cross-border payments which are slow, costly, and difficult to audit/validate. The remedies will remain complex as long as different countries have different currencies with different convertibility rules. Banks may require multiple wallets with different central banks or multiple currency wallets with their central banks.

A universal CBDC wallet is similar to Mark Carney’s synthetic hegemonic currency (SHC) through a network of CBDCs, or even the earlier bancor suggested by Keynes or Richard Cooper’s single currency. Such initiatives require global cooperation which is absent. When IMF’s policy decisions require an 85% vote, the US with its 17% vote enjoys a de facto veto. For the same reason, one suitable candidate, the IMF’s Special Drawing Rights (SDR), though weak as a medium of exchange, cannot be expected to replace the dollar. What may be required is a complete rethinking of global monetary relations and mechanism.

CBDC in India

With a Digital Rupee announced in the budget for 2022-23, discussions on the design are on. Digital payments have been the norm for large value payments. But, digitalisation has been gaining ground in retail. It is therefore not clear that a case for CBDC has really been made out and that the benefits outweigh the costs.

A specious argument put forward for CBDC is the saving on currency printing costs and logistics should not be the criterion. Most of these are fixed costs and will not come down proportionately with decline in cash in circulation. These arguments overlook the significant investment required in infrastructure and maintenance of CBDC.

Design choices are critical, with later changes unduly risky and costly. Further, most big central banks are still learning. There is perhaps merit in being prudent and watchful to reap leapfrogging benefits later. Therefore, paraphrasing Alexander Pope, the poet, why rush in where angels fear to tread.

Conclusion

Cryptos resulted from mutually reinforcing innovations in digital and financial technologies. Cryptos can improve speed and transparency, and reduce costs, but cannot eliminate multiple currencies or the need for exchange rates and related risks. With BigTech firms leveraging network effects to issue their cryptos, central banks are coming up with their responses.

Currency requires trust to be credible and accepted, especially as medium of exchange and store of value. Digital trails are no substitute for trust implied in government backing and central bank management. Central banks can issue currency almost at will making its supply elastic and the natural choice as medium of exchange.

Prasad predicts separation of the functions of money with central bank currencies remaining the store of value. Those issuing CBDCs would retain the medium of exchange function, with increasing challenge from private players as entry barriers become lower. Those enjoying network benefits could become more dominant. While the US dollar will remain the dominant position as global store of value and unit of account, it could lose traction as a medium of exchange.

Postscript

After reading Prasad’s heavily researched and brilliantly written book, one still has many questions:

Are global banks and payment companies making central banks fight their turf war with the private cryptos? In other words, are they shooting from the shoulders of the central banks?

Technology can end the fungible nature of money, but at what cost to privacy and freedom? How can one achieve a balance?

Faced with the force of technology, will new monetary unions emerge outside Europe? s

Financial inclusion will improve but will it deepen the digital divide of haves and have nots?

Whatever be the shape of the evolving currency landscape, we are witnessing the slow and sure demise of metallic coins and banknotes. What will be the character of financial intermediation, the way central banks function, and the tools at its disposal?

Prasad ends thus: “Problems such as corruption, government ineptitude, the rapaciousness of the economic and political elites, and inequality within and between countries will continue to fester.” He concludes, “Technology, after all, is no match for human nature.”

Assume Jevons were still alive. As also his father or the son, Herbert Stanley Jevons, who established the Economics Department at Allahabad and was the first President of the Indian Economic Association and first editor of the Indian Economic Journal. He would still want to send his money, as “it would still be a disagreeable weight on his mind.”

Note:

A shorter and edited version appeared in The India Forum.

© G Sreekumar 2022

For periodical updates on all my blog posts, subscribe for free at the link below:

https://gsreekumar.substack.com/

![]()

One thought on “CBDC and the Future of Money”

Comments are closed.