No other economist would have probably had more books written on his life than John Maynard Keynes. I am currently reading, slipping in time whenever I can, a recent book by Zachary D. Carter, “The Price of Peace: Money, Democracy, and the Life of John Maynard Keynes” (Random House, New York, 2020). I hope to able to write a brief review of the book soon.

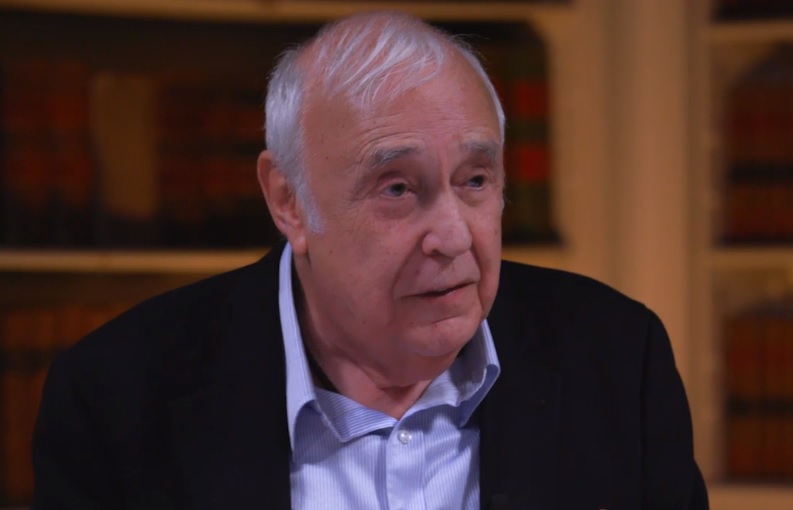

In the meantime, my attention was drawn to this list of five books on Keynes, his life and work. The list was drawn up by Robert Skidelsky, another biographer of Keynes, who wrote “John Maynard Keynes: 1883-1946: Economist, Philosopher, Statesman”, a single volume biography which is a condensed version of his three volume magnum opus on the life of the economist. The three volumes on Keynes were titled “John Maynard Keynes: Hopes Betrayed, 1883–1920” (published in 1983, Keynes’s centenary year), “John Maynard Keynes: The Economist as Savior, 1920–1937”, and “John Maynard Keynes: Fighting for Freedom, 1937–1946”.

Roy Harrod

The first book on Skidelsky’s list is The Life of John Maynard Keynes by Roy Harrod, the economist, best known for the Harrod-Domar model of economic growth. This book is the only official biography of Keynes. According to Skidelsky, Harrod had the benefit of knowing both Keynes and his time very well. But, there are three big omissions, Keynes’s “conscientious objection to the First World War”, his homosexuality, and his “quarrel with the United States over the reparations from Germany after the war, which Keynes felt had too many strings attached and compromised independence”. As he sums up, “Harrod essentially omits anything that might muddy Keynes’s reputation as the great saviour.” Though Skidelsky calls the book a bit of a hagiography, he says that it dealt with the economics very well. He sums up this economics as follows:

“Keynes attacked the classical economists who believed that economies are essentially fully employed such that government intervention is unnecessary. He said that economies are subject to slumps and crises and that if crises happen then we must pump air into the leaky balloon, much like the stimulus package now. His realisation was that economies are unstable, that they deflate and slide, that unemployment can go up and people suddenly don’t spend as much, that this is likely to happen from time to time and governments should prevent it from happening because the costs are so huge.”

Keynes was largely ignored during the Reagan and Thatcher years, and for long after that. A view that has changed after the financial crisis of 2008.

Paul Davidson

The second book in Skidelsky’s list is John Maynard Keynes by Paul Davidson (Palgrave Macmillan, 2009). Skidelsky calls Davidson a “lonely pioneer”, and his book on Keynes, “a straight, honest, succinct statement of what Keynes was about and it has the great merit of putting uncertainty at the centre of Keynesian theory.” According to Skidelsky, uncertainty which made people reluctant to spend, was central to the Keynesian economic world view, as opposed to that of the neoclassical economists, which he calls the “Newtonian view of economics,” where “a pendulum swings to the left and right but ends up back in the middle.” Skidelsky credits Davidson for focussing on the uncertain expectations, which he follows in his own books on Keynes.

Hyman Minsky

The third in books on Keynes is by Hyman Minsky. This is also titled John Maynard Keynes, and marketed as “Hyman P. Minsky’s Influential Re-interpretation of the Keynesian Revolution,” the reference to the revolution forming part of the title of many a book on Keynes, including one by Lawrence Klein, the econometrician and Nobel Laureate.

Minsky taught at an obscure university in St Louis and his death in 1986 went largely unnoticed. However, as Skidelsky says, “he made a very important contribution to Keynesian economics. He thought that financial systems ought to be a way of transforming money, a conduit between people who had a bit of money to invest and others who needed to borrow that money.” But, he emphasised the speculative nature of financial systems where people were making a lot of money by mere speculation. He had anticipated the moment where financial systems become source of instability when people borrow more and more in the expectation that the underlying security will appreciate in value until its becomes unsustainable as in a Ponzi scheme. That point is now referred to as the Minsky moment.

Justyn Walsh

The fourth book in the list is by Justyn Walsh, a hedge fund manager. It is titled “Keynes and the Market: How the World’s Greatest Economist Overturned Conventional Wisdom and Made a Fortune on the Stock Market.” The book tracks Keynes’s career as an investor and links it with his theory. Keynes made a lot of money in his investments, but he also lost a lot. Even those who work in financial systems know that the future is uncertain and volatile. Keynes came to the conclusion that one should not speculate, and should put money in a solid company, with the relationship lasting long like a marriage. But, today, most relationships seem to be like one night stands.

The mistake of Reagan and Thatcher were thinking in abstract terms and believing that markets were more efficient than governments. They therefore “dismantled all Keynes’s barriers against untrammelled greed and, since then, there have been five big financial crises”. The period of deregulation ended with privatisation of profits and tax payers bearing the losses.

Anand Chandavarkar

The fifth and the last in the list of books on Keynes is one by Anand Chandavarkar. The book listed here is “The Unexplored Keynes and other Essays: A Socio-Economic Miscellany,”(Academic Foundation, 2009). Skidelsky probably had in mind Chandavarkar’s earlier book, “Keynes and India: A Study in Economics and Biography” (1989). Keynes’s association with India started with his days at the India Office in London. Later he contributed to the stabilisation of the rupee, and creation of a central bank for India. (More on this later). Chandavarkar started his career as an academic and as an economist with the Reserve Bank of India. He later moved to the IMF and the World Bank. His other books include “Central Banking in Developing Countries.”

According to Skidelsky, Chandavarkar “…sort of fell in love with Keynes. This is a wonderful collection of essays about different aspects of Keynes’s life. But he does have this love affair with Keynes and he believes that Keynes was passionately interested in India, which he actually wasn’t. He deals with Keynes’s refusal to go to India for six months on a Royal Commission, saying that it was just an excuse, that he was in love and wanted to get married. He said that Keynes would never have sacrificed his love of India for a woman. But he did. So Chandavarkar is very romantic. But he deals with Keynes not just as an economist but as a philosopher and a moralist. This book shows his range of interests and his contribution to 20th-century thought.”

Skidelsky concludes, “Read that if you want a broader view of Keynes in the 20th-century.”

In addition, of course, to his own many books on Keynes.

© G Sreekumar 2021

For periodical updates on all my blog posts, subscribe for free at the link below:

https://gsreekumar.substack.com/

![]()