Background

There are two reasons why I am celebrating the centenary of the South African Reserve Bank (SARB). First, I learnt my first lessons in central banking as an undergraduate in 1978 from the classic book on central banking by M.H. de Kock (see here). A legendary and longest serving Governor of the SARB, de Kock’s book went into four editions in his lifetime. It was also popular across the world. References to the Bank and its history were therefore inevitable in my lectures on central banking over the years.

The second reason is my recent association with the SARB as a banking supervision advisor for the International Monetary Fund. This assignment took me to Pretoria once and a chance to interact with many officials of the Bank. Thereafter, I have also had many online sessions with regulators and supervisors of SARB and other Southern African central banks during the pandemic lockdown.

The SARB was established on 30 June 1921, during the early years of the peculiar financial conditions that followed the first world war. This had prompted John Maynard Keynes to write in 1920 one of his early classics, The Economic Consequences of the Peace. In one of the first best sellers in Economics, Keynes had argued for a more generous peace process that also took into account economic prosperity of the entire Europe. But, this was prevented by the Treaty of Versailles, a critique of which was at the core of the book.

The International Monetary Conference held in Brussels in 1920 urged countries without a central bank to establish one to promote financial stability. This was reiterated in the next such conference held in Genoa in 1922. But, by then, the SARB had already been established.

Establishment

The background to establishing the South African Reserve Bank lies in the convertibility of South Africa’s currencies into gold. Such convertibility into a base metal was the order of the day when commercial banks issued banknotes, which had to be backed by gold. But the price of gold in the United Kingdom rose and became higher than the gold price in South Africa. Therefore, a profit could be made by converting banknotes into gold in South Africa and selling the gold in London. This meant that commercial banks had to buy gold at a higher price in London (for re-import into South Africa to back their banknotes in issue) than the price at which they converted their banknotes into gold. This “obligation to trade at a loss” posed a serious threat to the ability of banks to continue meeting their obligations.

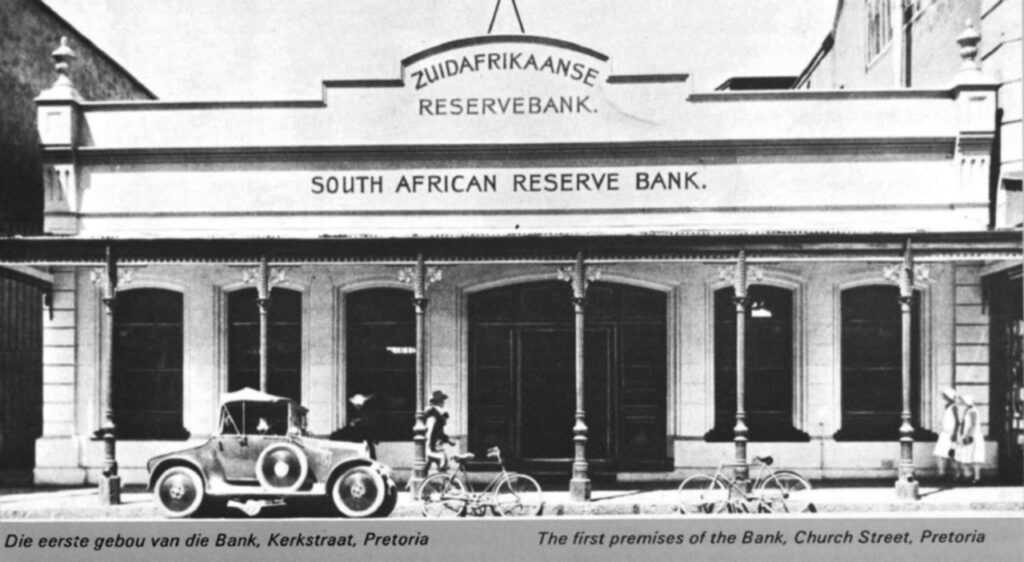

For financial viability, it became necessary to discontinue the commercial bank obligation to convert their currency into gold on demand. They requested the government which held a Gold Conference in October 1919. Following its recommendations, a Parliament Committee recommended the establishment of a central bank to for taking over the currency function and the gold with commercial banks. Accepting the recommendation, the Parliament passed the Currency and Banking Act in December 1920. This Act provided for establishing the SARB. At the time, the SARB had two main objectives. First, to restore and maintain order in the issue and circulation of domestic currency. Second, to restore the gold standard to the pre-World War I rate of exchange. The SARB was inaugurated on 30 June 1921. It issued its first banknotes on 19 April 1922. The SARB was the first central bank in Africa.

First Governors of the SARB

William Henry Clegg, who was Chief Accountant with the Bank of England, was appointed as the first Governor of the SARB. He remained in that position till December 1931. Montagu Norman, the legendary Governor of the Bank of England, had identified Clegg for the role. Norman played a similar role for central banks of other British colonies and dominions, including the Reserve Bank of India (I will cover this later in a separate post). Clegg later became a director on the Court of the Bank of England from 1932 to 1937, when Norman was still the Governor of the Bank.

Johannes Postmus succeeded Clegg as the second Governor, for 13 years. Michiel Hendrik de Kock succeeded Postmus for 17 years from 1945 to 1962. A career central banker, by the time he took over as Governor, de Kock had already published his classic work on central banking in 1939. He was earlier a Deputy Governor from 1931. After his tenure as Governor, he chaired the Board of Directors for a year and a half, and thereafter as a member till 1970. Thus, his association with the SARB lasted nearly four decades. Later, his son, Gerhard de Kock, would also become Governor of SARB, from 1981 till his death in 1989.

Changes in objectives

The South African Reserve Bank Act, 1944, replaced the Act of 1920. The new Act extended indefinitely the SARB’s initial right to issue banknotes for 25 years. In the meantime, South Africa had abandoned the gold standard in 1932, a year after the Bank of England did. In the new arrangement, SARB linked its currency to the pound sterling. Three months after it became an independent republic in 1960, South Africa introduced rand as its new currency on 14 February 1961.

The South African Reserve Bank Act of 1989 replaced the colonial era Act of 1944. Based on the new Act, its mission statement of 1990 aimed at protecting the internal and external value of the rand. This objective, to protect the value of the currency, is the primary goal of the SARB in the Constitution of the Republic of South Africa Act, 1996.

Between 2000 and 2004, the SARB restated its objective as “the achievement and maintenance of financial stability”. Thereafter, from 2005, the Bank changed it to “the achievement and maintenance of price stability”.

Other landmarks

The other major landmarks in SARB’s history are as follows:

- 1985: Adopted the dual rand system. This followed introduction of exchange controls to stem capital outflows on account of debt default and economic sanctions. The sanctions formed part of various anti-apartheid policies followed by the country’s major trading partners and their businesses. Under the dual rand system, one exchange rate was for the current account payments of resident. The the other was for the capital account payments of non-residents. Thus, foreign investments could be sold only for financial rand. This aimed at controlling capital outflow. The government abolished the dual rand system in 1995.

- 2000: Adopted inflation-targeting monetary policy framework. It now targets a band of 3 to 6 percent of consumer inflation.

- 2008 to 2010: In the context of the global financial crisis, cut repurchase rate by 650 basis points. It increased the focus on financial stability.

- 2020: In the context of the Covid-19 pandemic, SARB cut the repurchase rate by 225 basis points.

© G. Sreekumar 2021.

For periodical updates on all my blog posts, subscribe for free at the link below:

https://gsreekumar.substack.com/

![]()